what is fit tax on paycheck

Single filers 10. An individuals paycheck for state income taxes.

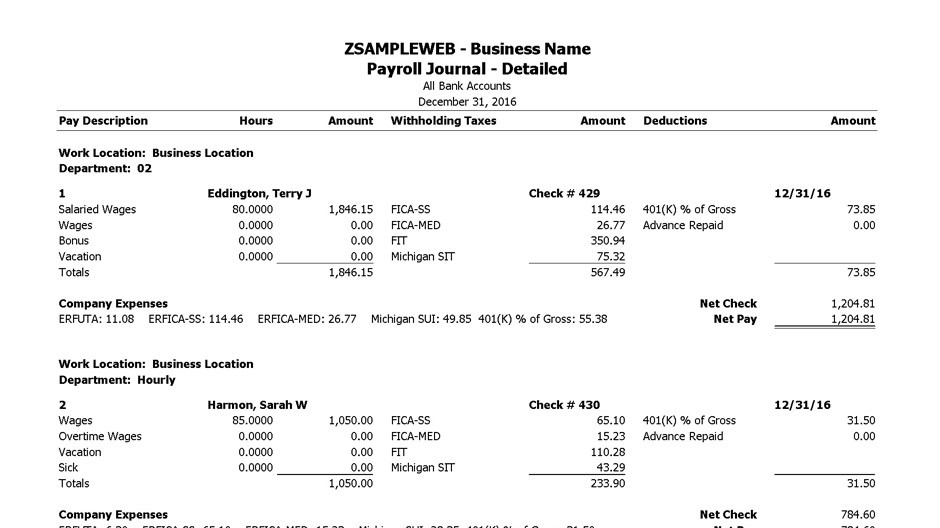

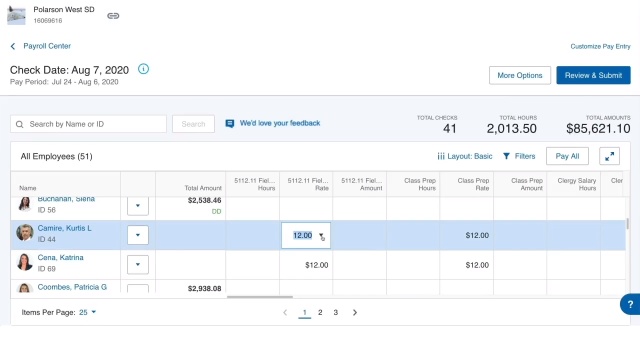

Free Payroll Reports Mypay Solutions Thomson Reuters

10 12 22 24 32 35 and 37.

. Income taxes are taxes on income both earned salaries wages tips commissions and unearned interest dividends. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. What is the fit tax rate for 2020.

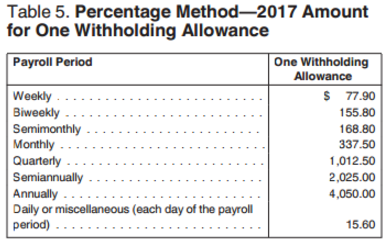

If youre one of the lucky few to. The employee is responsible for. Employers withhold FIT using either a percentage method bracket method or alternative method.

The Tax Cuts and Jobs Act of 2017 changed the federal income tax rates to what they are now. Your net income gets calculated. Single filers may claim 13850 an increase.

It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. Gross is hours x rate or. FICA taxes are commonly called the payroll tax.

All wages salaries cash gifts from employers business income tips gambling. How It Works. If youre one of the lucky few to.

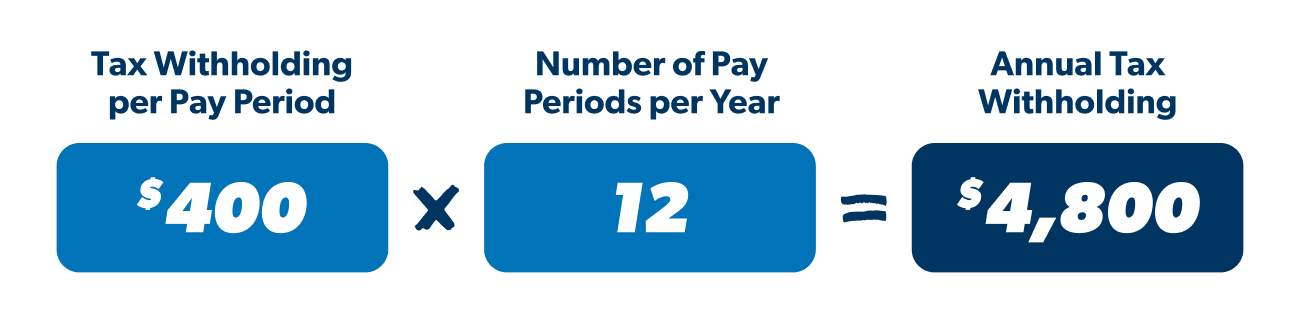

See how your refund take-home pay or tax due are affected by withholding amount. For most people FIT are the taxes that. The amount of income tax your employer withholds from your regular pay.

With this information you can prepare for tax season. Use this tool to. The federal income tax is a tax on annual earnings for individuals businesses and other legal entities.

Blakeh95 1 min. FIT Taxable Wages Federal Income Tax Taxable Wages. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37.

These are the rates for. There are seven federal tax brackets for the 2021 tax year. For employees withholding is the amount of federal income tax withheld from your paycheck.

Income between 11001 and 44725 22. Sometimes you or your spouse may owe a tax debt to the IRS or a debt to other agencies including child support or student loans. Fit stands for Federal Income Tax Withheld.

Income of 11000 or less 12. FICA taxes consist of Social Security and Medicare taxes. There are seven federal income tax rates in 2022.

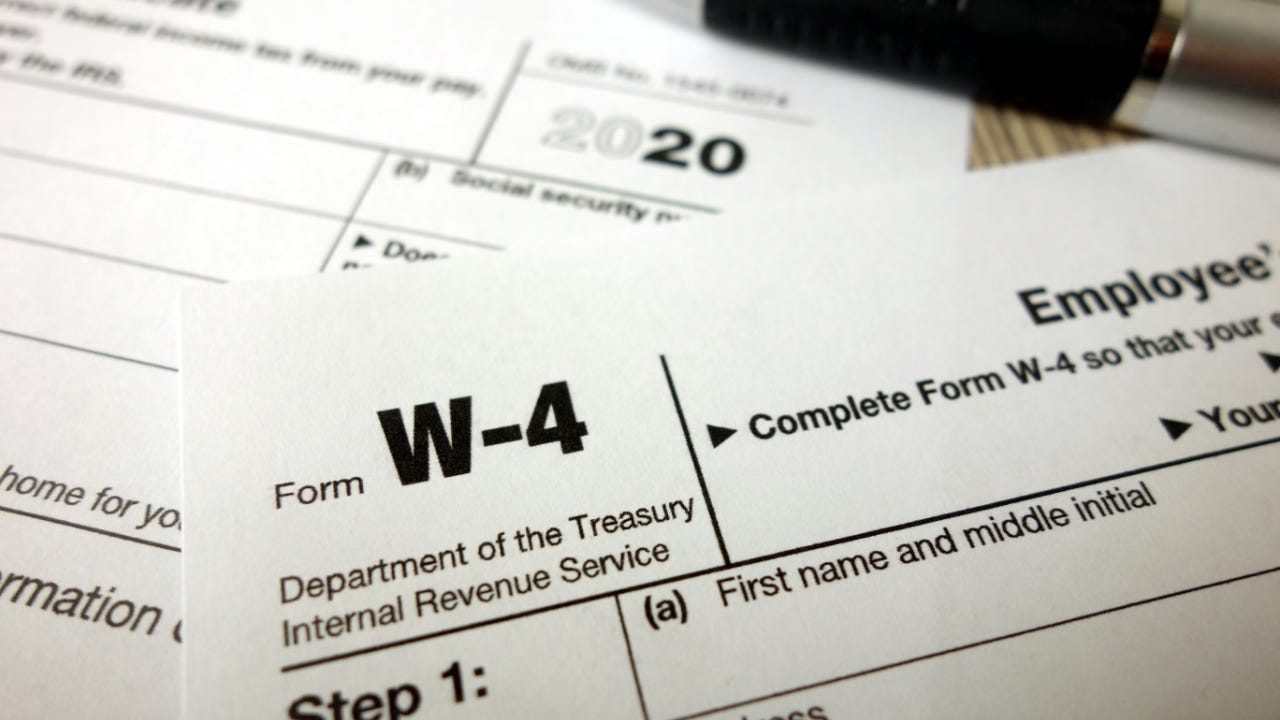

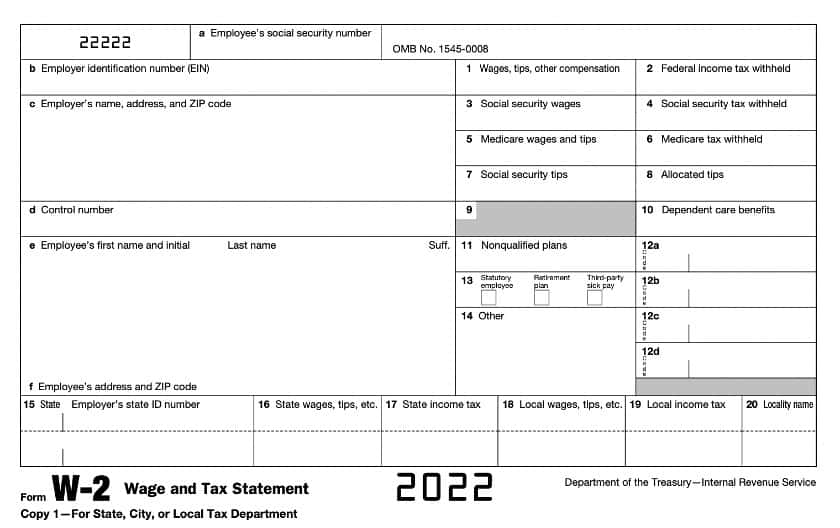

Here are the marginal rates for tax year 2023 depending on your tax status. FIT tax is calculated based on an employees Form W-4. FICA taxes are commonly.

Fit is the amount required by law for employers to withhold from wages to pay taxes. It sounds like you have about 150 of payroll deductions in one of those categories. The federal income tax rates remain unchanged for the 2020 and 2021 tax years.

What percentage is fit tax. However the new rates are only temporary they expire after 2025. The federal income tax is a tax on annual earnings for individuals businesses and other legal entities.

Estimate your federal income tax withholding. What is fit on my paycheck Refund used to pay other debts. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The FIT is a form of tax on yearly incomes for businesses individuals and additional lawful entities. The Federal Income Tax Brackets. However they dont include all taxes related to payroll.

Your bracket depends on your taxable income and filing status. All salaries cash gifts wages from business income gambling income employers. The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022.

10 12 22 24 32 35 and 37.

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

How Are Payroll Taxes Calculated Federal Income Tax Withholding Payroll Services

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

What Are Employer Taxes And Employee Taxes Gusto

12 Payroll Forms Employers Need

How Do I Read My Pay Stub Gusto

:max_bytes(150000):strip_icc()/FormW-42022-92779be669a64b0da38ce644c949a9c6.jpeg)

Form W 4 What It Is Who Needs To File And How To Fill It Out

![]()

How To Calculate Payroll Taxes Step By Step Instructions Onpay

How To Calculate Payroll Taxes Tips For Small Business Owners Article

Types Of Taxes The 3 Basic Tax Types Tax Foundation

Who Owns Your Paycheck Life And My Finances

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

2022 Federal Payroll Tax Rates Abacus Payroll

Payroll Services Online Payroll Software Paychex

Understanding Your Tax Forms The W 2

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding